Net-Zeroing the World

Technology Providing

What We Do

How It Works

When it Launches

Winter 2024

Benefits of Software

“What gets measured, gets managed.” – Peter Drucker, management guru

Having an accurate estimate of carbon, methane, and nitrous oxide emissions, heavy-emitting companies can better deploy mitigation strategies, such as, direct air capture for enhanced oil recovery, to reap the financial benefits of the Inflation Reduction Act’s (IRA) 45Q tax incentive and avoid penalties associated with excess emissions. Also, from 2024 onward, heavy-emitting companies with Scope 3 emissions accounting for greater than 40% of its GHG footprint will be required to report to the SEC. This tailor-made software will do the analysis and filing for you.

Methodology

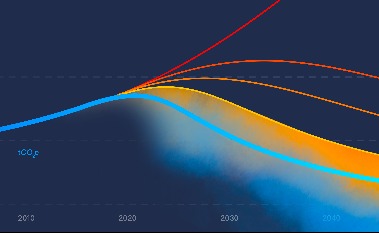

To get accurate emission readings at the asset-level, only a hybrid-approach that incorporates a top-down approach with remote sensing and a bottom-up approach underpinned by emission-factor based methods can account for large, stochastic carbon, methane, and nitrous oxide emissions.

Remote sensing can provide on-site, primary data inputs to Oil Production Greenhouse Gas Emissions Estimator (OPGEE) for upstream emissions and the Petroleum Refinery Life-Cycle Inventory Model (PRELIM) for midstream emissions, two underlying models provided by Oil Climate Index + Gas (OCi+).

The Scopes platform can bring transparency to emission-intensive sectors at scale and to companies currently underreporting or self-reporting. Accuracy can empower shareholders and stakeholders to pinpoint net-zero efforts for maximal impact.

Industries Serving

Oil & Gas

Utilities

Mining

Agriculture & Food and Beverage

Forestry

Chemicals

Crypto Assets

Government Agencies

Textiles

Manufacturing

Data Centers

Restaurants And Beverages

Coal

Steel

Transportation

History

December 2022

Speaker at the Caribbean Energy, Oil & Gas Summit (CEOGS) Port of Spain, Trinidad & Tobago

Industry Related Articles

SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors

The required information about climate-related risks also would include disclosure of a registrant’s greenhouse gas emissions.

The time for public companies to prepare to meet SEC climate rules is now

The SEC estimates that the first-year cost of complying with the proposal will be $640,000 for companies.

Understanding the SEC’s proposed climate risk disclosure rule

The US Securities and Exchange Commission (SEC) has a proposed a new rule that, if adopted, would require public companies.

Announcing our Series B & new advisory team to grow our global business

We work with companies like Airbnb, sweetgreen, DoorDash, Warby Parker, Twitter, Flexport, and Shopify.

Leading Climate Tech Company, Persefoni Announces $50 Million Series C1 and Next AI

Persefoni, a leading Climate Management & Accounting Platform (CMAP) for enterprises and financial institutions.